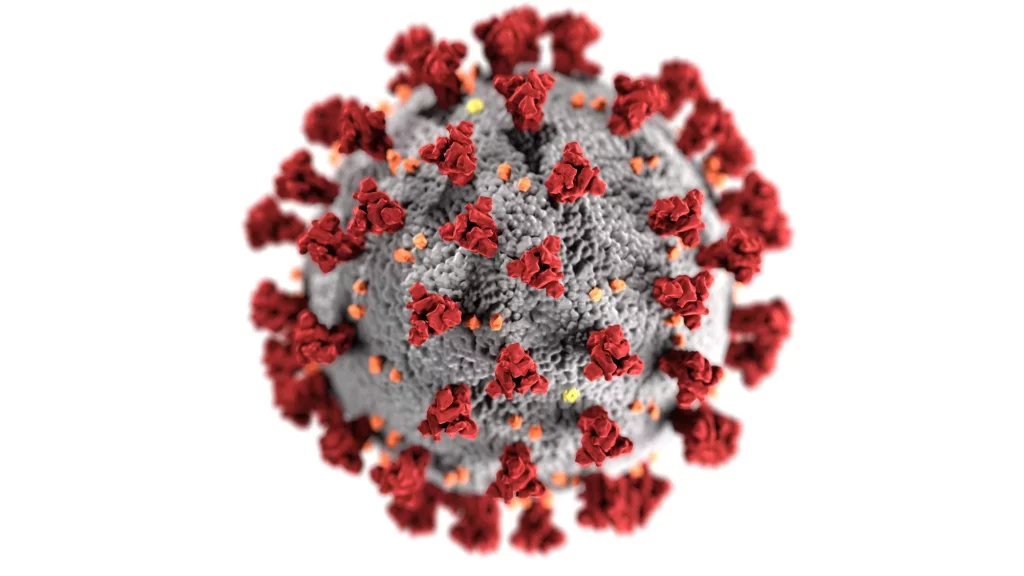

COVID-19 RELIEF BOND

This unique COVID-19 Relief Bond, which has a starting price of USD 250,000, is a government bond without an interest component, for which the applicant is not required to pay a processing fee. After its first issuance, the bond must be registered and held in the applicant’s name. This bond option is only accessible until December 31, 2021.

View the Bond Prospectus released on July 15, 2020, by the government of Saint Lucia.